Are you still debating the implementation timelines for AI? Your competitors are already ahead and expected to increase their revenue by 12% through AI transformation by 2028.

How do we know? PwC 2024 Asset & Wealth Management Report says so.

To stay in the race, your risk committees need predictive insights, not reactive reports. Your compliance teams require real-time monitoring across increasingly complex regulatory landscapes. Your portfolio managers need support in creating hyper-personalized portfolio strategies at enterprise scale.

In this post, we have everything you need to make the shift from static to intelligent portfolio management. We will also tell you how the right partner (like RTS Labs) can help you pull this off swiftly and promptly.

What is AI in Portfolio Management?

AI in portfolio management is the use of artificial intelligence to enhance the management of investment portfolios. AI processes large datasets quickly, detects hidden risks, and adapts to market changes, enabling efficient, risk-aware portfolio management.

AI helps portfolio managers address and adapt to:

- Operational risks: Detecting anomalies in workflows and automating compliance monitoring

- Market risks: Predicting market volatility with historical trend and real-time data analysis

- Technology risks: Assessing infrastructure vulnerabilities and recommending the best possible adaptive models

- Liquidity risks: Evaluating the market and simulating crisis scenarios for rapid-preemptive response

- Credit risks: Acquiring counterparties using alternative data and behavioral models

What technologies are used in AI-based portfolio management?

To compete at the enterprise level, portfolio managers need more than dashboards, they need a technology stack that accelerates returns, sharpens risk insights, and enables dynamic strategy shifts. Here are the core technologies making that possible:

| Technology | Use Case |

|---|---|

| Advanced Algorithms | Optimize asset allocation, scenario planning |

| Machine Learning Models | Forecast asset returns, identify non-linear patterns |

| Real-Time Data Analytics | Monitor market shifts, news, and events instantly |

| Predictive Modeling | Anticipate portfolio performance and macroeconomic changes |

| Quantitative Finance Techniques | Gauge market mood using news, social media, and earnings reports |

| Automated Rebalancing Engines | Develop risk-adjusted models |

Suggested read: AI in Financial Planning

Difference Between Traditional and AI-Based Portfolio Management

Here’s how traditional portfolio management differs from AI-based portfolio management:

| Aspect | Traditional | AI-based |

|---|---|---|

| Data usage and processing | Static and historical data | Real-time data uses insights derived from historical data |

| Decision making | Manual analysis and intuition-driven | Continuously learns and adapts, with fewer biases |

| Portfolio optimization | Based on periodic reviews and set human rules | Optimizes continuously; learns from performance patterns |

| Rebalancing | Performed at fixed intervals, often causing delays | Automated rebalancing based on predictive indicators |

| Information sources | Financial reports, analyst opinions, and historical metrics | NLP-scanned news, sentiment data, and market feeds |

| Investment strategies | Fixed traditional strategies | Dynamic and tailored strategies |

| Adaptability and flexibility | Limited flexibility; no rapid adjustments to market conditions | Adapts in real-time based on new data or portfolio goals |

| Risk management | Relies on historical risk assessments and manual risk mitigation strategies | Real-time risk assessment and proactive risk mitigation |

| Time efficiency and Speed of Execution | Relatively time-consuming and slower execution cycles | Automates everything from screening to allocation; has faster execution |

| Human involvement | High | Uses human oversight, limited dependency |

| Response to market volatility | Slow response | Rapid response predicts volatility before it occurs |

How AI Is Transforming Portfolio Management?

AI fundamentally transforms portfolio management from rigid, reactive strategies to dynamic, intelligent systems. Here’s how:

- Real-time rebalancing: Automatically adjusts portfolio based on live market conditions, investor behavior, and risk tolerance changes, without waiting for quarterly cycles

- Predictive modeling: Forecasting market movements, allowing managers to take action before volatility hits using historical trends, economic indicators, and real-time data

- Risk-adjusted personalization: Delivering a hyper-personalized client experience, tailored to individual risk appetites, financial goals, and behaviors

- Market signal analysis: Uncovering actionable insights and anticipating price movements by scanning news, earnings calls, macro data, and social sentiment

- Intelligent risk monitoring and stress testing: Continuously analyzes portfolios for hidden risks and simulates various market stress scenarios

How AI in Portfolio Management Works

When your firm’s proprietary data, investment policy, and expertise are paired with AI, it creates a scalable, adaptive, and risk-aware system. This enables a structured portfolio management process that unifies data, strengthens forecasting, and streamlines decision-making.

Here is the breakdown of each step:

Step 1: Gathering Data from Multiple Sources

This is the foundation of AI-driven portfolio management, consolidating fragmented datasets into a unified intelligence layer. It begins with the comprehensive gathering of inputs critical to investment strategy and risk management.

Some of these sources include:

- Client profiles: Demographic details, investment goals, risk appetite, transaction history, and behavioral patterns

- Market data: Real-time and historical information on stock prices, indices, commodities, interest rates, and foreign exchange

- Disclosures and reports: Annual reports, earnings statements, and regulatory filings from public companies and financial authorities

- Research and insights: Industry analyses, proprietary insights, and reports from investment firms and independent organizations

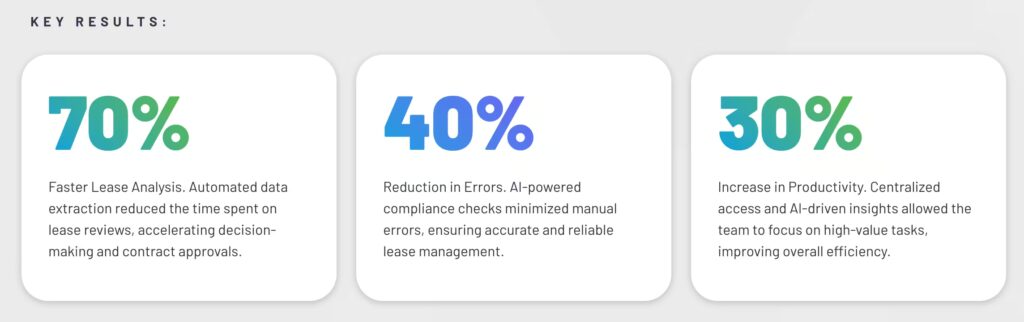

RTS Labs’ exponential success rates in automating data extraction, reducing errors in compliance checks, and increasing productivity.

Step 2: Processing and Organizing Data

Once collected, this data is funneled through automated data pipelines, which are responsible for:

- Ingesting data from multiple formats

- Cleaning it, removing duplicates and correcting inconsistencies

- Structuring it into formats compatible with AI models

The AI system ingests data, cleans it, standardizes and aligns it across different schemas and formats to derive accurate, consistent, and actionable insights.

Create your AI-driven portfolio management system

Automate data processing and reduce judgment errors in your portfolio management service with RTS Labs

Step 3: Feature Engineering

Relevant variables, like moving averages, sentiment scores, or volatility bands, are created from raw inputs. These features help models detect relationships between market events and portfolio performance.

These features are the core inputs that drive predictions, asset allocation strategies, and risk forecasts.

For example, feature engineering can turn raw stock prices into 20-day moving averages or momentum indicators, which provide stronger predictive signals than the raw prices alone.

RTS Labs teams support clients in identifying high-impact financial features and engineering custom inputs tailored to investment goals, risk models, and data availability, ensuring better model precision and business alignment.

Suggested read: How to Prepare and Preprocess Data for ML Models

Step 4: AI Model Development and Training

AI model development involves selecting and training models aligned to portfolio goals. It includes processing structured and unstructured data, like earnings transcripts, using embedding models to extract sentiment, themes, and signals, enabling accurate forecasting, risk detection, and strategic decision-making.

RTS Labs supports this phase by helping firms select and train the right AI models, fine-tune them for investment-specific objectives, and embed responsible AI practices, ensuring accuracy, transparency, and integration into operational workflows.

Step 5: Portfolio Construction and Optimization

The next stage involves applying AI-generated insights to portfolio construction and optimization. This includes selecting the right mix of assets and optimizing allocations to meet goals such as maximizing return, minimizing risk, and aligning with client mandates.

AI analyzes asset relationships, adjusts to market changes, balances constraints, and runs simulations to identify optimal portfolio allocations.

RTS Labs supports clients in developing AI-driven optimization models that incorporate risk constraints, client preferences, and regulatory requirements, enabling more adaptive, goal-aligned portfolio strategies.

Step 6: Execution Layer

Trade placement and capital allocation are triggered by AI-generated portfolio decisions. By analyzing market depth and timing, AI improves execution quality, reduces slippage, and selects optimal routes. This step must be precise, fast, compliant, and cost-efficient, especially in volatile markets.

RTS Labs supports this layer by integrating AI models into existing execution systems and automating workflows through secure, scalable infrastructure, allowing faster, rules-driven trade execution that meets compliance and performance benchmarks.

Step 7: Real-Time Monitoring and Automated Rebalancing

AI tracks market volatility, news, and client inputs against defined thresholds. When deviations occur, it triggers rebalancing, sends alerts, or suggests alternatives. Asset weights are adjusted automatically to maintain target allocations.

RTS Labs helps firms deploy real-time AI systems that monitor key portfolio signals, automate response actions, and support threshold-based triggers. This helps your portfolios stay aligned with investment intent and risk posture.

Step 8: Predictive Analytics and Sentiment Analysis

At this stage, AI models analyze real-time market data and behavioral signals to detect patterns that suggest price shifts, volatility, or changing asset correlations.

Simultaneously, sentiment analysis applies NLP to unstructured inputs, news, reports, and social media, to extract tone and topic relevance. The system translates this into vector embeddings, which inform predictive models and portfolio decisions.

RTS Labs supports this by building custom NLP pipelines and predictive models that analyze financial language, identify forward-looking signals, and surface actionable insights in real time.

Step 9: Risk Management and Anomaly Detection

AI-powered systems transform how firms identify, monitor, and respond to potential threats. They combine real-time data, predictive modeling, and anomaly detection to help you shift from reactive responses to intelligent, preventive strategies.

AI systems developed by RTS Labs continuously track how market shifts affect portfolios and update risk metrics based on real-time inputs and evolving data.

Step 10: Feedback and Continuous Learning

Feedback and continuous learning are key to the system’s evolution over time, as it uses new data and outcomes to fine-tune investment strategies without requiring manual reprogramming.

RTS Labs enables continuous learning by integrating feedback loops and retraining mechanisms that improve model accuracy and performance as more data becomes available.

Step 11: Deployment and Ongoing Monitoring

This phase involves translating model outputs into operational systems that integrate with your existing portfolio workflows.

RTS Labs provides full-stack AI deployment and MLOps (Machine Learning Operations) solutions, ensuring that models remain reliable, secure, and aligned with production-scale execution requirements.

Benefits of Using AI in Portfolio Management

Why should you be investing in AI in portfolio management? Well, because of these benefits:

Faster and More Accurate Decision-Making

Large volumes of structured and unstructured data are processed in seconds, supporting investment decisions that are both timely and evidence-based. Trade execution happens instantly, keeping pace with rapid market movements.

Better Risk Management

Volatility forecasts, early warning signals, and real-time stress tests give risk teams the information they need to act ahead of disruption. AI continuously recalibrates risk models based on new market and portfolio data.

Personalized Investment Strategies at Scale

Each client’s risk appetite, investment objective, and behavior inform portfolio design, without manual segmentation. AI enables personalized strategies across thousands of portfolios simultaneously.

Improved Portfolio Rebalancing and Return Potential

Rebalancing isn’t reactive. AI tracks performance drift, reallocates assets as needed, and runs simulations to find the most return-efficient mix, keeping portfolios aligned with defined objectives.

Cost and Operational Efficiency

Manual tasks like data validation, document processing, and trade routing are automated end-to-end. This reduces process delays, improves accuracy, and lowers overhead.

Faster Client Onboarding and Profiling

Document checks, AML validations, and policy extractions happen automatically. AI routes clean, verified data to relevant teams, shortening onboarding cycles and improving experience.

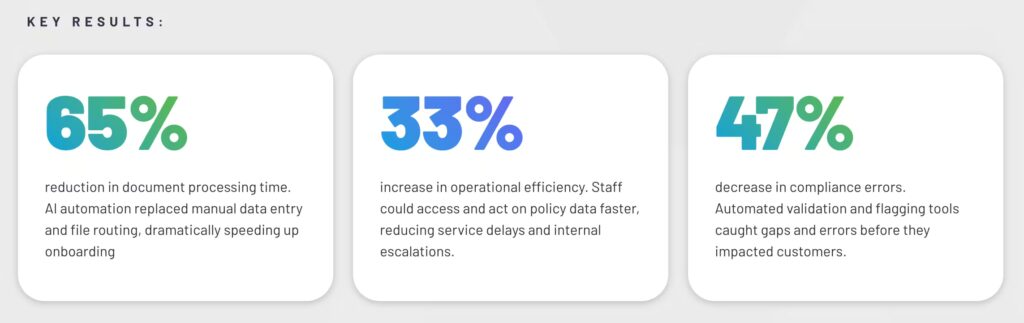

RTS Labs’ success in Streamlining Onboarding and Policy Processing with AI for a Leading Insurer.

Enhanced Compliance Monitoring

Rules engines continuously scan portfolios for constraint violations or regulatory risks. Alerts are generated before thresholds are breached, allowing early intervention with minimal human review.

Use Cases of AI in Portfolio Management

It is evident now that AI enables smart asset allocation, automated trade execution, and real-time decision-making, helping firms stay ahead in volatile markets. In addition to foundational use cases, AI delivers high-level functionality in :

1. AI-Powered Asset Allocation:

AI analyzes historical data, risk models, and market indicators to construct asset mixes aligned with investor profiles. It dynamically adjusts allocations as goals, timelines, or macroeconomic conditions evolve.

Example: A high-net-worth investor nearing retirement receives a dynamically adjusted allocation that shifts exposure from growth equities to fixed income as market volatility increases and time horizon shortens.

According to a J.P. Morgan Asset Management study, portfolios using AI-driven tax loss harvesting (TLH) achieved up to 30 basis points (0.30%) in additional annual after-tax returns compared to traditional TLH strategies.

2. Risk Assessment and Management:

Machine learning models evaluate portfolio exposure across multiple dimensions, market, credit, liquidity, by processing real-time and historical data. This allows faster recalibration of strategies when risk thresholds are breached.

Example: When oil prices spike unexpectedly, the AI model instantly flags the energy-heavy portfolios at risk and suggests derivative-based hedging options tailored to the client’s exposure.

3. Intelligent Decision-Making with Real-Time Market Analysis:

AI ingests news, sentiment signals, and market data to detect early indicators of volatility, price swings, or correlation breakdowns, helping managers act before markets fully price in the change.

Example: During a sudden policy announcement, AI interprets real-time news sentiment and recommends reducing positions in interest-rate-sensitive assets before the bond market reacts.

4. Automated Trade Execution:

Algorithms identify optimal execution routes across exchanges and liquidity providers. Trades are placed at the best available price with minimal slippage or delay, especially under high-frequency conditions.

Example: Instead of routing a large-cap stock trade through a single exchange, the system splits and executes the order across venues to reduce price impact and secure better average execution.

5. Adaptive and Strategic Portfolio Optimization:

Optimization models balance return, risk, and constraints like ESG mandates or sector caps. AI runs thousands of scenarios to identify the most efficient allocation under current and forecasted conditions.

Example: A portfolio manager targeting ESG compliance uses AI to exclude fossil fuel exposures while still meeting return targets by reallocating toward clean energy and infrastructure funds.

6. Automated Portfolio Rebalancing:

AI detects drift from target allocations due to market movements. It rebalances holdings using pre-defined rules or predictive triggers to maintain alignment with investor intent and minimize tax impact.

Example: When tech stocks in a portfolio outperform and breach the sector cap, AI rebalances the overweight automatically, selling excess positions and reinvesting in underexposed sectors within seconds.

7. Predictive Monitoring for Personalized Financial Decisions:

Scenario simulations forecast how life events, interest rate shifts, or geopolitical changes could impact a client’s portfolio. AI aligns these forecasts with individual risk profiles and timelines.

Example: A client planning for college tuition in five years receives a simulation showing how a 100-basis point rate hike would affect their bond-heavy portfolio, and an AI-driven adjustment recommendation follows.

8. Efficient Order Management:

From pre-trade checks to post-trade reconciliation, AI streamlines order flow across systems. It reduces manual bottlenecks, ensures compliance with mandates, and flags routing inefficiencies.

AI flags a batch order delayed due to compliance mismatches and reroutes it with corrected parameters, avoiding end-of-day execution spikes and regulatory issues.

9. AI-Driven Robo-Advisors for Personalized Investment Advice:

These tools synthesize financial goals, income, and behavioral inputs to recommend tailored portfolios. They adjust strategies continuously and deliver advisor-grade guidance without increasing advisory headcount.

According to the Deloitte Center for Financial Services, AI-driven investment tools will become the primary advisors for retailers, growing from a nascent stage to 78% usage by 2028.

Example: An early-career professional inputs goals into a robo-advisor, which instantly recommends a low-cost, high-growth portfolio aligned to income, risk appetite, and expected expenses.

10. Fraud Detection and Compliance Automation:

AI monitors portfolios in real time to identify suspicious trades, wash-sale risks, or non-compliant activity. Anomaly detection models surface issues early, reducing regulatory and reputational risk.

Example: When an unusually large trade is made outside normal patterns, AI halts execution, alerts compliance, and logs the anomaly, preventing potential mandate violation.

Suggested Read: How ML is boosting Fraud Detection across various industries

11. Investor Communication and Reporting Enhancements:

Natural language generation (NLG) tools turn portfolio data into personalized performance summaries, market commentary, and actionable insights, automating communication at scale without compromising relevance or clarity.

Example: Instead of sending a generic performance summary, AI generates a customized report showing how a client’s ESG investments outperformed peers, with clear, jargon-free explanations and market context.

Role of AI in different types of portfolio management

The role and impact of AI change with different investment styles. Here’s how each portfolio type is enhanced:

Active Portfolio Management

- High risk–high reward strategy that relies on frequent trades and tactical shifts.

- AI reduces bias and speeds up reviews with real-time alerts, scenario simulations, and explainable dashboards.

- RTS Labs supports this by automating performance analysis and unifying fragmented decision data.

Passive Portfolio Management

- Follows a low-trade, benchmark-driven approach, vulnerable during volatile markets.

- AI adds adaptability through continuous monitoring and automated rebalancing when deviation occurs.

Discretionary Portfolio Management

- Managers take full control of investment decisions based on client mandates.

- AI enables personalization at scale by analyzing client data, risk tolerance, and market trends.

- RTS Labs builds automation workflows to align portfolio logic with individual profiles.

Advisory Portfolio Management

- Clients retain decision-making power while managers provide recommendations.

- AI helps scale personalized advice using NLP-based tools, automated documentation, and compliance-ready reporting.

Institutional Portfolio Management

- Manages high-value, multi-asset portfolios with complex governance needs.

- AI supports fast, rule-based decisions, reduces manual overhead, and improves visibility across siloed systems.

How does this look in the real world?

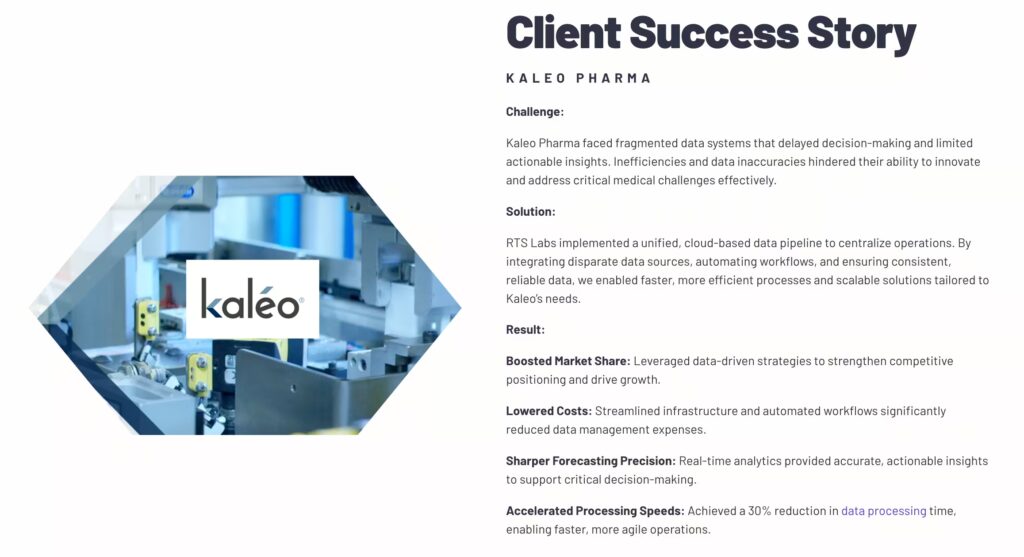

RTS Labs helped an insurance company overcome an overly complex data infrastructure that limited access and delayed onboarding. Strict governance and permission structures hindered the deployment of advanced ML tools, further complicating the process. By implementing a unified data lake and training internal teams, RTS enabled faster decision-making and scalable analytics, essential for portfolio managers facing similar data governance and agility challenges.

Read more success stories from RTS Labs here

How to Implement AI in Portfolio Management with RTS Labs

Implementing AI in portfolio management involves building a scalable, intelligent system that aligns with your firm’s goals. This is why RTS Labs follows a comprehensive and strategic process to implement AI in your portfolio management solutions.

Before moving ahead, read how you can align AI initiatives with your business objectives

- Discovery and AI readiness assessment: Evaluates your current systems, identifies gaps, and assesses your AI readiness, ensuring efforts are aligned with business goals

- Strategic roadmapping and use-case identification: Works with you to define high-impact, feasible AI use cases (like automated rebalancing or predictive analytics) based on ROI, data availability, and operational value

- Data engineering and integration: Builds robust data pipelines that consolidate market, client, and transactional data, making it usable for AI models across your portfolio operations

RTS Labs used predictive analytics to help a client increase their net profit by 23%, demonstrating the real-world impact of AI-driven insights on business performance.

- AI model development: Develops custom ML models, optimized for forecasting, risk profiling, client segmentation, sentiment analysis and proactive monitoring

- Solution integration and testing for quality assurance: Integrates these models into your portfolio systems, trading platforms, and advisory tools. Conducts rigorous testing to ensure system accuracy, scalability, and compliance

- Training and change management: Equips your team with skills and workflows to adopt AI seamlessly, ensuring successful buy-in across investment, compliance, and IT teams

- Ongoing monitoring and support: Offers continuous support for optimization, regulatory updates, and AI model tuning based on performance and feedback

Explore RTS Labs’ Process to learn how they turn AI into measurable portfolio outcomes.

The Future of Portfolio Management Is AI-Driven , Let’s Build It Together

AI has the potential to quickly become the foundation of forward-thinking firms, driving performance, personalization, and resilience in a volatile market. As the market evolves and becomes more complex, client expectations also grow, and AI empowers portfolio managers to shift from a reactive to a proactive strategy execution.

However, you need a robust system that is accurate and immaculate. RTS Labs fits the bill perfectly with its deep expertise in AI, finance, and enterprise-grade integration support.

Discover how RTS Labs assisted Twiddy OBX vacation rentals in automating their processes and integrating systems by collaborating closely with their internal team, as well as their homeowner advisory board.

RTS Labs helps you build scalable, intelligent solutions tailored to your goals. When you partner with RTS Labs, you get:

- End-to-end delivery, from strategy to execution

- Custom-built solutions aligned to your KPIs

- Compliance-first, audit-ready engineering

- Real-time results that deliver ROI from day one

Whether you’re automating risk, personalizing advice, or scaling insights, RTS Labs helps you build smarter portfolios, faster.

Start your AI journey with RTS Labs

FAQs

Can AI really outperform human portfolio managers?

AI can process vast amounts of data faster than humans and often identifies patterns humans may miss. In certain quantitative and data-heavy strategies, it can outperform human managers, but it works best when combined with expert human judgment.

How much does AI portfolio management cost compared to traditional methods?

AI solutions can reduce long-term operational costs by automating processes and increasing efficiency. While initial setup and integration may be higher, they typically result in lower per-client servicing costs and improved scalability compared to traditional methods if you partner with the right technology partner.