A lot of executives in the financial services sector ask us the same things: How can we grow revenue and enhance the customer experience – but while also reducing risk and cutting costs? What many financial services firms don’t realize is that many of the problems they face are actually data problems. “Can analytics and software really solve these problems?” The short answer is – yes. With the right data and the right business intelligence technology, your financial services firm can accomplish a great number of things. In fact, let’s take a closer look specifically at 3 common data problems financial services firms face (and how to solve them).

If you’re like many firms out there, you’re probably working with some legacy software that may have been cutting edge at one point but now isn’t as nimble or easy to use as it needs to be for your current client load. A lot of financial services firms face the following challenges:

- Slow data analysis times

- Time-consuming manual data gathering and tracking for deals and transactions

- A lack of executive analytical insight

What are the data solutions for each of these 3 common data problems for financial firms?

Making analysis time faster

If you have unconnected data living in disparate sources (as is often the case in legacy systems), your reporting and analyzing processes are not as efficient as they could be. When data is not pulled into one central location, it’s more likely unreliable and can’t be delivered in real time.

With the right understanding of what you need from your data – and the right software solutions – you can connect the data between disparate data sources, such as your CRM, Sharepoint, and accounting and financing programs. You can automate the connections and use a business intelligence tool to create standard reports for all your needs. An automated business intelligence system like this increases your velocity to analysis (AKA speeds up your data analysis time). As a result, your firm gets real-time line of sight into key metrics, such as industry performance, revenue growth, revenue per resource, and utilization rates.

Photo credit: RTS Labs/Ashley Ray

Photo credit: RTS Labs/Ashley Ray

Replacing manual data gathering and tracking with automation

Is your organization committing a lot of time and resources to tracking things manually rather than automating them? Tracking opportunities, deals and client utilization takes a tremendous amount of time away from what you should be focusing on: finding and closing deals. Leveraging data automation, machine learning, and data science puts your team back in the business of working with people, not spreadsheets.

Another pain point is fielding client questions concerning their accounts. Manually creating reports or pulling data for clients is time consuming. Dashboards and automation can alleviate that pain by putting data at your and the clients’ fingertips. You may even be able to go a step further and create a self-service portal for your clients – giving them faster access to answers and information and freeing up your time even further.

Improving executive analytical insight

You can’t drive a ship blind. If your executive team doesn’t have access to the insights and analytics necessary to make forecasting and management decisions, your firm is in trouble. Unfortunately, this problem is not uncommon. It all goes back to legacy programs and disparate data sources.

With advanced deep-dive analytics, you can have executive dashboards with real-time data and access to any report, share of wallet snapshot, financial buyer analysis, and fund analysis – all at your fingertips.

The outcome for financial services firms

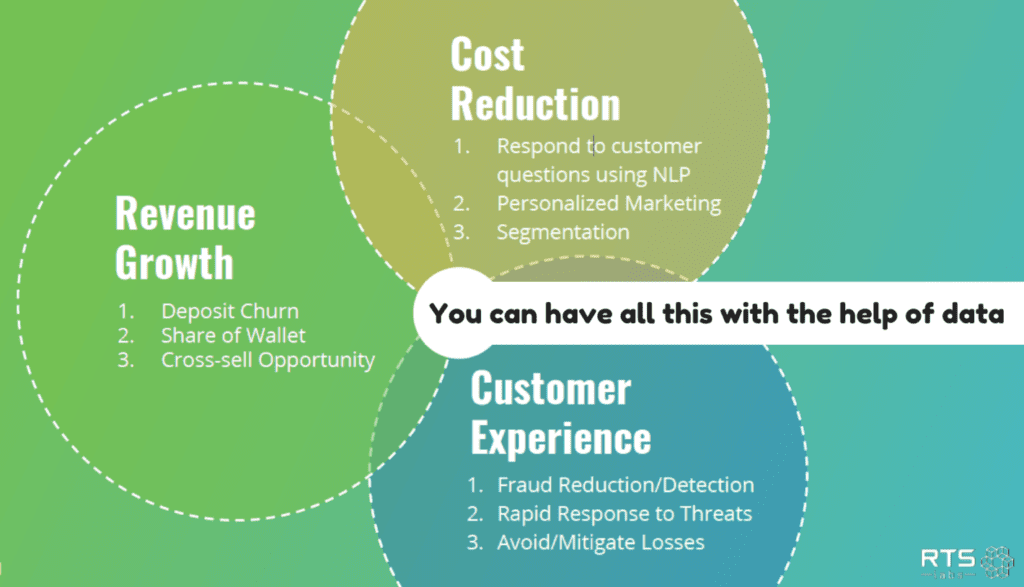

What do you get when you combine automation with interactive analytical dashboards and all the data you can dream of? You get the tools needed to drive revenue growth, reduce risk, lower costs, and enhance customer experience.

Revenue growth

That’s the goal (or at least one of the main goals) of every business out there, isn’t it? To be more profitable? Solving for these three common challenges with analytics and software means lower deposit churn (or attrition rate), increased share of wallet, and more cross-sell opportunities. Improving any of these three things can make a difference in your profit margins.

Cost reduction

With dashboards and automation, you spend less time on administrative tasks and more time closing deals. You can automate your marketing activities to create personalized marketing campaigns with advanced business intelligence. Using more automation cuts the cost of chasing down leads and brings them to you using artificial intelligence.

Customer experience and risk reduction

With advanced customized software, you can offer deeper insights and better reports to clients. Better software can also mean better security overall. With better built-in security, you can reduce fraud, improve fraud detection, and accelerate your response to threats, thus improving the customer experience while avoiding and mitigating loss and risk.

With the right data team and technology solutions, your firm’s biggest challenges can be solved. Want to read a real-life case study on how becoming “data happy” helped a financial services client? Download this true client story.