Insurance fraud drains the U.S. economy of $308 billion annually, adding about $900 per policyholder in higher premiums. In 2025 alone, federal investigators uncovered $14.6 billion in fraudulent schemes across health and property insurance. With fraud tactics evolving this fast, insurance companies have to catch up with advanced insurance fraud analytics.

Traditional rule-based systems create false positives and miss organized fraud rings. Insurance fraud analytics solves this by combining AI, predictive modeling, and advanced data science.

This blog post shares real examples from the insurance companies using insurance fraud analytics, compares AI with traditional methods, and outlines a practical roadmap so you can integrate insurance fraud analytics into your existing detection systems.

What Is Insurance Fraud Analytics?

Insurance fraud analytics includes techniques such as anomaly detection, natural language processing, and machine learning models that analyze claims, policies, and customer data to identify suspicious patterns early.

For example, when an insurance company processes a corporate policy claim, fraud analytics tool can automatically pull in data from past claims, underwriting details, and third-party sources like repair shops or medical providers. The system highlights inconsistencies, such as inflated service costs or repeated claims for similar incidents, and flags them for review before payout so the company avoids fraudulent expenses.

Traditional Rule-Based Fraud Detection vs. AI Fraud Detection in Insurance

Is relying solely on traditional rule-based fraud detection enough? The table below shows the key differences:

| Aspect | Rule-Based Fraud Detection | AI Fraud Detection Analytics in Insurance |

|---|---|---|

| How It Works | Predefined rules and thresholds (e.g., claim > $10,000 flagged) | Machine learning models analyze vast datasets and learn patterns dynamically |

| Flexibility | Static; requires manual updates when fraud tactics change | Adaptive; continuously improves as new fraud behaviors emerge |

| Accuracy | High false positives; legitimate claims often flagged | Lower false positives; identifies subtle, complex fraud patterns |

| Data Usage | Limited to structured data and basic cross-checks | Combines structured (claims, payments) and unstructured data (documents, images, notes) |

| Scalability | Labor-intensive; not effective with high claim volumes | Automated, scalable across millions of claims in real time |

| Business Impact | Slower claim processing, higher investigation costs | Faster fraud detection, reduced losses, better customer experience |

While rule-based systems provide a starting layer of defense, they fall short against modern fraud schemes. AI fraud detection in insurance delivers scalable, adaptive, and more accurate insights that help insurers cut costs and process legitimate claims quickly.

How Fraud Analytics Works in Insurance

Here’s a step-by-step process of how insurance fraud analytics detects frauds.

Step 1: Data Collection

Insurers gather information from claims, policies, customer profiles, billing records, and third-party databases. An AI partner sets up connectors and APIs to pull both structured and unstructured data into a unified system.

Suggested read: Essential Strategies for Ethical and Effective Web Data Collection in AI

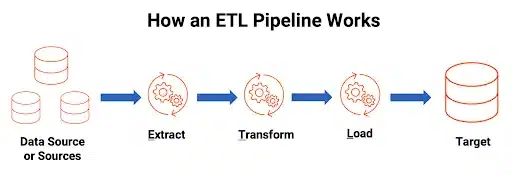

Step 2: Data Processing and Integration

Pipelines clean, normalize, and merge data from multiple sources, eliminating silos and ensuring consistency. A fraud analytics solution builds ETL pipelines and applies governance rules to maintain high data quality.

Step 3: Predictive Modeling

An AI partner develops supervised and unsupervised models tailored to specific fraud scenarios, and retrains them as tactics evolve. These models score claims in real time, comparing them to historical fraud cases or detecting anomalies.

Step 4: AI-Powered Analytics

Advanced fraud detection platforms combine algorithms with domain-specific tuning to capture subtle fraud signals missed by rules-based systems.

- NLP extracts insights from contracts and adjuster notes.

- Behavioral analytics tracks unusual claim activity or provider behavior.

- Anomaly detection surfaces irregular patterns across transactions.

Step 5: Alerts and Action

High-risk claims are flagged for investigation, while legitimate claims move forward quickly. Fraud analytics integrates with claims management systems and automatically routes alerts to investigators.

Benefits of Insurance Fraud Detection Analytics

Adopting insurance fraud analytics helps insurers overcome long-standing challenges in fraud detection and claims management. Here’s how:

1. Reduced Fraud-Related Losses

Fraudulent claims that slip through traditional checks drive up costs for both insurers and policyholders. Predictive modeling flags high-risk claims before payout, cutting losses that the Coalition Against Insurance Fraud estimates cost the USA around $3B annually.

2. Fewer False Positives

Rule-based systems often generate excessive false alarms, forcing investigators to waste time on legitimate claims. Machine learning models detect subtle patterns, lowering false positives so fraud teams can prioritize genuine cases.

3. Faster Legitimate Claim Processing

Valid claims are frequently delayed when they’re caught in manual fraud checks. Fraud analytics filters out suspicious cases automatically and only allows genuine claims to move quickly.

4. Stronger Compliance and Governance

Federal guidelines cover AML (KYC, suspicious activity reporting) and fraud prevention, while the NAIC develops model laws on solvency, claims, and consumer protection. So the NAIC standardizes state insurance regulations, though adoption is optional.

However, providing compliance is difficult when detection systems lack transparency. Fraud analytics provides explainable outputs, audit trails, and bias monitoring to support evolving insurance regulations.

5. Higher ROI and Efficiency

Manual reviews consume investigator time and inflate operational costs. Automated fraud detection saves hours, reallocates resources, and generates measurable ROI through cost reduction and efficiency gains.

High-Value Use Cases Across Insurance Lines

Fraud schemes vary widely across insurance products, and fraud detection analytics in insurance adapts to each scenario by analyzing diverse data sources and patterns.

Auto Insurance

An auto insurer uncovered a staged accident fraud network using analytics and achieved $1M in subrogation recovery in one month and $12M within six months. Staged accidents, inflated repair costs, or false injury claims are common in auto fraud. Analytics combines repair shop data, claims history, and telematics to identify anomalies and flag suspicious cases before payouts.

Fraud analytics now also uses telematics and IoT-driven incident verification to confirm whether an accident occurred as reported, helping carriers filter out staged claims in real time.

Health Insurance

False billing, duplicate claims, and upcoding are frequent in healthcare fraud. “Operation Gold Rush” uncovered a $10.6B Medicare fraud ring. AI and data analytics prevented over 99% of fraudulent payments, triggering a federal AI-powered fraud prevention initiative.

Predictive models analyze medical records, billing codes, and provider behavior to detect irregularities that would escape rule-based checks.Beyond billing analytics, insurers are applying network analysis to uncover hidden provider–patient fraud rings by mapping suspicious connections across claims.

Property Insurance

Fraudulent claims often involve exaggerated damages, arson, or inflated repair invoices. Fraud analytics cross-references historical claim data, property records, and external risk factors to validate claims quickly.

A major insurer managing dense portfolios of property and health policies reduced policy review times by 60% by partnering with RTS Labs’ AI solution that automated contract summarization, metadata extraction, and natural language search. It improved efficiency and reduced fraud exposure tied to lengthy manual reviews.

Life Insurance

Fraud schemes include false death claims, beneficiary manipulation, or misrepresentation in applications. Emerging graph-based models are being used to detect networked fraud rings and anomalies, aligning with cutting-edge research in adaptive analyticsMachine learning models assess application histories, network relationships, and suspicious activity patterns to flag cases for deeper review.

Claims Management Optimization

Across all insurance lines, fraud analytics integrates directly into claims workflows. Low-risk claims move forward automatically, while high-risk cases are routed to investigators. This triage approach reduces manual workloads, accelerates payouts for legitimate claims, and lowers investigation costs.

Implementation Challenges in Fraud Analytics

Even with strong business cases, insurers may face hurdles when implementing fraud detection analytics in insurance.

Siloed Claims and Policy Data: Fraud patterns often span multiple policies or lines of business, but insurers keep claims, underwriting, and customer data in separate systems. And as Jyot Singh, the CEO of RTS Labs said “giving AI systems bad data is like asking a Golden Retriever to drive a Ferrari”.

Connecting AI to Legacy Insurance Platforms: Many carriers still rely on decades-old policy administration or claims systems. Embedding AI models into these platforms can cause delays and errors without API-based integrations or middleware designed for insurance workflows.

Regulatory Pressure on Fraud Detection Systems: Insurance fraud analytics solutions must comply with standards like NAIC, GDPR, and HIPAA. Without explainable outputs and clear audit trails, insurers risk penalties, lawsuits, or reputational damage when fraud decisions are challenged.

Bias and Accuracy in Fraud Models: Models trained on incomplete or outdated claims data may miss new fraud tactics or unfairly flag legitimate claims.

Adoption by Fraud Investigation and Claims Teams: Investigators and adjusters may resist AI insights if they feel the system replaces human judgment.

How RTS Labs solves these challenges?

RTS Labs addresses these challenges through end-to-end support—from breaking down data silos with scalable data engineering pipelines, to integrating AI models into legacy systems via API-first design.

Our solutions embed explainability and governance frameworks to meet regulatory standards, while ongoing model monitoring reduces bias and maintains accuracy. We also provide training and change management strategies so fraud teams can adopt AI smoothly, combining human expertise with data-driven insights.

Contact our team to learn more!

Roadmap for Adopting Fraud Analytics in Insurance

To successfully adopt insurance fraud detection predictive analytics, you need a structured, phased approach that balances technology, compliance, and people.

Step 1: Assess Readiness

Evaluate current data quality, infrastructure, and governance.

Are there any data silos across claims, underwriting, and policy systems?

Our team at RTS Labs can conduct readiness assessments to map data gaps, compliance requirements, and integration opportunities so insurers know exactly where to start.

Step 2: Identify High-ROI Use Cases

Review historical claims data to spot fraud “hot spots” such as inflated auto repair costs, duplicate health billing, or unusually high claim frequencies. Rank these cases by financial loss and ease of detection to prioritize where to start.

Our consultants collaborate with your claims and fraud teams to prioritize use cases with the highest financial impact and fastest ROI.

Step 3: Launch a Pilot or Proof of Concept (PoC)

Select one fraud type or line of business and develop a small-scale model. Use internal data scientists to design detection rules, test algorithms, and evaluate accuracy before scaling.

If resources are limited, we can rapidly build and validate a pilot model, using real claims data, and integrate it into workflows to deliver measurable outcomes in 90 days.

Step 4: Scale Across Insurance Lines

Expand fraud analytics from pilot projects to enterprise-wide solutions.

Engineers at RTS Labs integrate fraud detection models with legacy systems using API-first architecture to ensure scalability without disrupting existing workflows.

Step 5: Optimize and Govern Continuously

Monitor model accuracy, retrain as fraud patterns evolve, and embed governance frameworks.

With our support team, you get ongoing monitoring, retraining, and governance dashboards to ensure models stay accurate, explainable, and compliant with regulations.

Partner with RTS Labs for Insurance Fraud Analytics

Many AI vendors focus narrowly on building models without helping insurers decide when fraud analytics makes sense and when it doesn’t. For example, an off-the-shelf system might incorrectly flag low-value claims as fraud, creating unnecessary friction, while missing high-value complex fraud rings.

On the other hand, there are scenarios, such as detecting staged accident networks or analyzing provider billing anomalies, where fraud analytics delivers immediate ROI. The challenge is that most partners step in only at the implementation stage, leaving insurers to figure out strategy and adoption on their own.

RTS Labs takes a different approach. From the earliest stages of AI in Insurance strategy, we help carriers identify where fraud analytics adds value, and where it may not.

We then design AI consulting for insurance tailored to your data maturity, compliance requirements, and fraud priorities.

- Boutique, senior-led teams → You work directly with seasoned AI architects, not junior delivery staff.

- Custom fraud analytics solutions → We design predictive models, NLP pipelines, and IoT/graph-based analytics tailored to your insurance lines.

- Fast time to value → From pilot to production in as little as 90 days.

- Regulatory-ready AI → Our solutions embed explainability, audit trails, and governance to align with NAIC, GDPR, HIPAA, and state-level insurance regulations.

- Proven results → From reducing policy review times by 60% to streamlining fraud detection workflows, we’ve delivered real outcomes for insurers and financial services firms.

All in all, we help insurers:

- Reduce fraud-related losses

- Accelerate legitimate claims processing

- Strengthen compliance and governance frameworks

- Build AI fraud detection tailored to their operations

- Gain measurable ROI with real-world impact

Talk to our insurance AI experts today and explore how RTS Labs can strengthen your fraud detection efforts!

FAQs on Insurance Fraud Analytics

1. How does AI improve fraud detection in insurance?

AI fraud detection in insurance continuously learns from new fraud tactics, reduces false positives, and identifies hidden patterns like staged accidents or duplicate claims that traditional rule-based systems often miss.

2. Which insurance lines benefit most from fraud analytics?

Fraud analytics applies across auto, health, property, and life insurance. Use cases include staged accident detection, false billing prevention, property damage validation, and identifying false death claims or beneficiary misrepresentation.

3. How quickly can insurers see ROI from fraud analytics?

Insurers often see measurable ROI within months, starting with pilot projects in high-risk claim areas. RTS Labs typically helps clients move from proof-of-concept to production in as little as 90 days.