Insurance carriers still process most claims by hand. Underwriters build risk models in spreadsheets. Compliance teams track regulation changes across disconnected systems.

The gap between potential and practice remains wide. Automation has cut claims processing time by 50% at leading insurers, with settlements now completed in hours rather than days, according to CoinLaw. Many insurance companies have adopted generative AI, yet most use it for narrow tasks: extracting text from documents, answering basic questions, or routing files based on fixed rules.

AI agents for insurance handle more complex work. A claims agent reviews damage evidence, checks coverage terms, flags inconsistencies against historical fraud patterns, and routes the file with a prepared summary. An underwriting agent pulls data from credit bureaus and telematics systems, evaluates risk exposure, and suggests pricing that fits both regulatory limits and carrier strategy.

This article covers how AI agents for insurance apply to claims, underwriting, compliance, and customer service. It examines the use cases generating returns, the obstacles during rollout, and how RTS Labs helps carriers build systems that balance performance with transparency.

What Are AI Agents

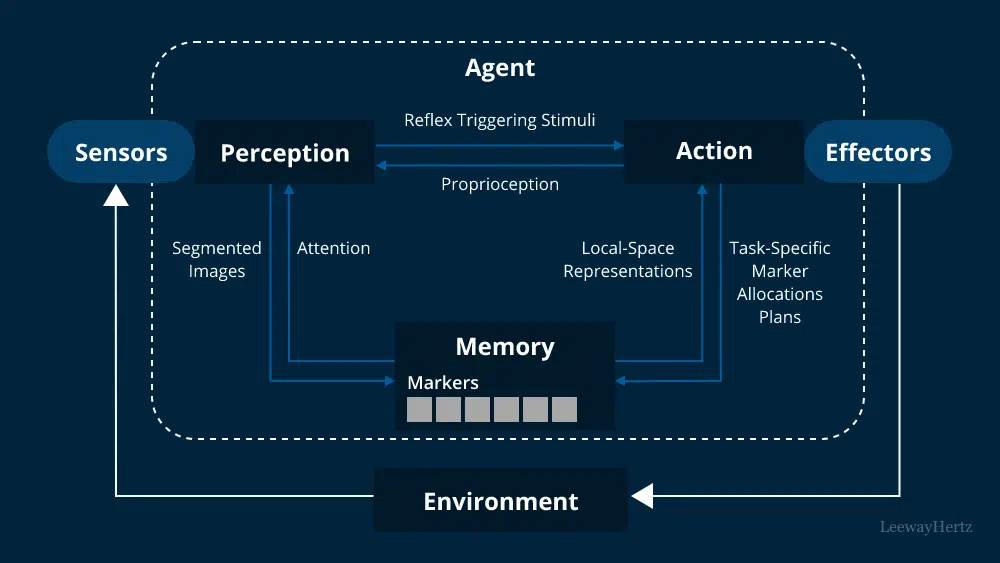

AI agents are intelligent, goal-driven systems capable of reasoning, learning, and taking action to achieve defined outcomes. Traditional automation tools or RPA bots merely execute preset tasks. In contrast, AI agents function with autonomy and contextual awareness. They interpret data, make informed decisions, and adapt their behavior as conditions change.

These systems are built on three foundational capabilities:

- Goal-oriented reasoning: They analyze objectives, available data, and constraints to determine the best course of action.

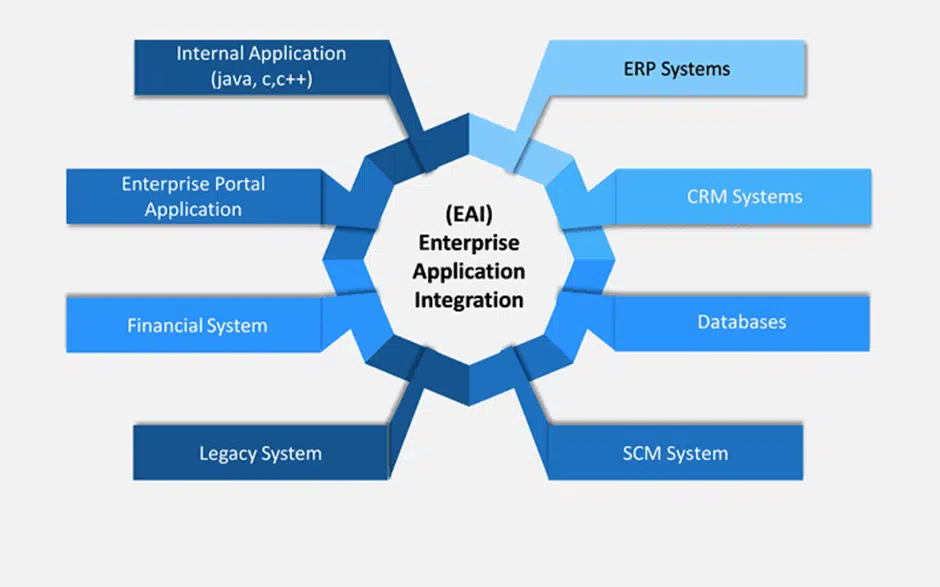

- Multi-tool integration: They can draw from multiple data sources or APIs, from policy databases to CRM systems, to inform decisions.

- Continuous learning: They refine their decision logic over time based on feedback, improving accuracy and responsiveness.

A simple analogy: instead of a chatbot that only answers questions, an AI agent might also update CRM records, verify policy details, generate a claim summary, and trigger the next workflow step automatically.

In essence, AI agents act as adaptive co-workers that extend human intelligence across digital operations, capable of working independently while collaborating seamlessly within enterprise ecosystems.

Suggested read: Insurance Fraud Analytics: Benefits & Use Cases (2025)

What Are AI Agents for Insurance

AI agents for insurance are specialized autonomous systems designed to understand the unique workflows, regulatory rules, and data models that govern the insurance industry. They go beyond generic AI automation — operating as intelligent assistants that handle domain-specific tasks such as claims processing, underwriting, policy servicing, and fraud detection.

Trained on structured and unstructured insurance data, these agents can interpret policy documents, assess risk profiles, and even detect inconsistencies in claims or compliance reports. Their actions aren’t limited to analysis — they can also execute follow-up steps such as initiating approvals, sending notifications, or updating policyholder records.

Common examples include:

- Claims triage agents that classify and route claims for faster resolution.

- Underwriting agents that analyze risk factors and recommend pricing adjustments.

- Fraud detection agents that monitor claim behavior patterns across multiple data points.

- Customer service agents that handle queries, renewals, and policy updates around the clock.

Think of these agents as digital specialists within the insurance value chain — each focused on a distinct function but capable of collaborating across systems.

RTS Labs helps insurers design and integrate such domain-trained AI agents into existing ecosystems, ensuring they operate with accuracy, compliance, and measurable impact.

Suggested read: Predictive Analytics in Insurance: Benefits, Use Cases & More (2025)

How AI Agents Work in Insurance

AI agents in insurance operate through a structured cycle of perception, reasoning, and action, enabling them to understand context, make informed decisions, and continuously improve performance. While each implementation differs by function (claims, underwriting, or fraud detection), most agents follow a similar workflow:

1. Input and Data Ingestion

The agent receives structured and unstructured data from multiple sources — claim forms, policy documents, call transcripts, or telematics data.

2. Understanding and Context Extraction

Natural Language Processing (NLP) and Optical Character Recognition (OCR) help interpret text, identify key entities (policyholder name, claim type, coverage limit), and extract insights that drive reasoning.

3. Decision-Making and Reasoning

Using embedded logic and trained ML models, the agent evaluates scenarios — for example, assessing claim validity or estimating risk probability. It determines the next best action based on business rules and learned outcomes.

4. Action Execution

The agent then takes contextual action — sending alerts, routing claims, generating underwriting reports, or even initiating payment approval through integrated APIs.

5. Feedback and Continuous Learning

Each decision and its outcome feed back into the system, allowing the agent to refine its reasoning models, reduce error rates, and improve accuracy over time.

Suggested read: AI’s Role in the Evolution of Insurance

Benefits of AI Agents in Insurance

For insurers, the shift from static automation to agentic intelligence delivers measurable improvements in speed, accuracy, and decision quality. AI agents not only perform tasks, they reason, adapt, and optimize operations across the insurance value chain.

1. Faster Claims Processing

AI agents can now process routine claims in minutes instead of days. Accenture reports that generative AI and intelligent automation can reduce end-to-end claims cycle times from days to minutes, significantly improving turnaround and customer satisfaction

2. Enhanced Fraud Detection

By analyzing patterns across historical claims, social data, and external databases, AI agents can flag anomalies early, helping insurers cut fraud-related losses by 10-20%, based on industry benchmarks from McKinsey.

3. Improved Underwriting Accuracy

Agents integrate risk data, predictive models, and third-party data sources to generate fairer, data-backed pricing decisions. This reduces underwriting errors and minimizes bias that often stems from human judgment.

4. Superior Customer Experience

With 24/7 intelligent support, policyholders receive faster responses, real-time policy updates, and proactive recommendations. AI agents maintain context across conversations, improving personalization and retention.

5. Operational Efficiency and Cost Optimization

Automating repetitive tasks, from document parsing to reporting, allows insurers to redirect human expertise toward higher-value work. Google’s latest study on Gen AI ROI in financial services found that 50% of firms reported employee productivity doubling due to Gen AI implementation.

TL;DR: Benefits of AI Agents in Insurance

- Faster Claims: Process routine claims in minutes instead of days

- Fraud Detection: Flag anomalies early and cut fraud losses by 10-20%

- Underwriting Accuracy: Generate fairer, data-backed pricing with reduced bias

- Customer Experience: Deliver 24/7 intelligent support with contextual personalization

- Cost Optimization: Double employee productivity through automation of repetitive tasks

7 Use Cases of AI Agents for Insurance

From underwriting to customer engagement, AI agents are reshaping how insurers operate. They go beyond traditional automation by reasoning across data, coordinating decisions across systems, and acting autonomously to improve outcomes. Below are seven high-impact ways insurers are applying AI agents today.

1. Claims Automation & Fraud Detection

AI agents automatically triage incoming claims, verify documentation, and detect anomalies that indicate potential fraud. They cross-reference policy data, customer history, and third-party databases to flag irregularities before payout.

Impact: Lower loss ratios and faster settlements.

Real-World Example – Reducing Policy Review Time for a Leading Insurance Client

A major financial and insurance firm partnered with RTS Labs to modernize its forecasting and policy-review workflows. The client faced delays and inaccuracies caused by manual data handling, leading to inconsistent decisions and missed growth opportunities. RTS Labs developed an AI-driven automation layer that streamlined data extraction, interpretation, and validation, reducing review cycles from days to hours.

By applying the same agentic automation principles that power modern AI agents, the system reasoned across multiple data sources and adapted dynamically to new patterns. The result: faster decision-making, improved forecasting accuracy, and greater confidence in underwriting and compliance operations.

2. Underwriting & Risk Assessment

Agents evaluate applicant data, historical claims, and market signals to recommend pricing or identify high-risk profiles. They can simulate “what-if” scenarios to fine-tune underwriting criteria.

Impact: More accurate pricing and reduced underwriting cycle times.

3. Customer Service & Policy Management

Conversational agents handle inquiries, renewals, and policy updates around the clock. They maintain conversation context across channels, escalating only complex cases to human agents.

Impact: Continuous service availability and higher customer satisfaction.

4. Regulatory Compliance & Reporting

Compliance agents monitor evolving regulations, flag discrepancies, and generate audit-ready reports automatically.

Impact: Reduced compliance risk and audit overhead.

5. Sales & Cross-Selling Support

AI agents analyze customer behavior and policy data to recommend relevant add-ons or bundled products.

Impact: Higher conversion rates and greater customer lifetime value.

6. Customer Onboarding & Verification

Agents perform Know Your Customer (KYC) and Anti-Money Laundering (AML) checks by scanning IDs, validating documents, and cross-verifying details against trusted databases.

Impact: Shorter onboarding cycles and improved accuracy.

7. Telematics & Usage-Based Insurance (UBI)

AI agents interpret IoT and telematics data to adjust premiums in real time based on actual driving behavior or risk exposure.

Impact: Dynamic pricing models and improved customer engagement.

Together, these use cases illustrate how AI agents move insurers from static automation to adaptive intelligence, where systems not only complete tasks but also reason, learn, and collaborate.

How Insurers Are Using AI Agents Today:

- Claims & Fraud: Automate reviews, detect anomalies, speed up payouts.

- Underwriting: Analyse risks, simulate scenarios, price accurately

- Customer Service: 24/7 policy support with seamless handoffs

- Compliance: Track rules, auto-generate audit reports

- Sales: Recommend add-ons and bundles to boost conversions

- Onboarding: Run fast, accurate KYC and AML checks

- Telematics: Adjust premiums in real time using IoT data

We at RTS Labs help insurance organizations design and deploy such agentic ecosystems, ensuring every implementation delivers measurable ROI, regulatory compliance, and operational scalability.

How to Integrate AI Agents into an Insurance Workflow

Adopting AI agents in insurance isn’t just a technology decision — it’s an organizational shift. Success depends on aligning business objectives, data readiness, and governance from the outset. Below is a practical roadmap insurers can follow to move from concept to production.

Step 1: Define Clear Automation Goals

Identify where agentic automation will deliver the most impact — such as claims triage, underwriting support, or compliance monitoring. Tie each use case to measurable KPIs like cycle-time reduction, accuracy improvement, or cost savings.

Step 2: Assess Data Readiness and Infrastructure

Audit the quality and accessibility of existing data across systems like CRM, ERP, and claims platforms. Clean, unified data is critical for effective reasoning and decision-making by AI agents.

Step 3: Start with a Pilot Use Case

Choose one workflow to validate the concept, for example, automating first-notice-of-loss (FNOL) claims or risk-scoring in underwriting. Use the pilot to test model accuracy, integration compatibility, and human-AI interaction.

Step 4: Choose the Right Development Path

Decide whether to implement an off-the-shelf solution or commission a custom-built agent tailored to internal workflows. Evaluate each option on flexibility, compliance alignment, and long-term ROI.

Step 5: Integrate Seamlessly with Existing Systems

Embed agents into current tools rather than replacing them. Modern frameworks like LangChain, CrewAI, and Azure Cognitive Services allow interoperability with policy-administration systems, document-management tools, and analytics platforms.

Step 6: Implement Human-in-the-Loop Oversight

Maintain transparency and control by involving human reviewers in sensitive decisions — such as claim denials or underwriting exceptions — to ensure accountability and trust.

Step 7: Scale and Optimize Across Functions

After validating success in one area, expand agentic capabilities across departments. Establish monitoring dashboards for performance, fairness, and compliance; retrain models periodically to reflect evolving regulations and market behavior.

Challenges & Ethics in AI Agents for Insurance

As insurers embrace AI agents, they must also navigate the ethical, regulatory, and operational challenges that come with autonomous decision-making. Building trust in AI-driven systems requires transparency, accountability, and human oversight at every stage.

1. Data Privacy and Security

AI agents often process sensitive customer information, from medical records to financial data. Any breach or misuse can have serious regulatory and reputational consequences. Ensuring encryption, access controls, and compliance with data-protection laws such as GDPR, HIPAA, and SOC 2 is essential for maintaining customer trust.

2. Bias and Fairness in Decision-Making

If agents are trained on biased or incomplete datasets, they can unintentionally replicate unfair outcomes in underwriting or claims decisions. Regular audits, diverse training data, and bias-detection frameworks help ensure fairness and equity in automated judgments.

3. Over-Autonomy and Lack of Explainability

Highly autonomous agents can make decisions that humans struggle to interpret. Without explainability, insurers risk non-compliance or loss of stakeholder confidence. Explainable AI (XAI) techniques and transparent reasoning models help clarify how each decision is made.

4. Compliance and Governance Complexity

Evolving regulations demand that insurers demonstrate how AI systems make and record decisions. Establishing audit trails, version control, and human-in-the-loop checkpoints ensures that agentic workflows meet both internal and external compliance standards.

5. Change Management and Workforce Readiness

Successful adoption depends on people as much as technology. Employees need clarity on how AI agents augment their roles, not replace them. Clear communication, upskilling, and role-based training foster collaboration between human and digital teams.

Off-the-Shelf vs Custom AI Agents for Insurance

Insurers can either adopt ready-made (off-the-shelf) solutions or invest in custom-built agents designed around their specific workflows, data models, and governance requirements. The right choice depends on business maturity, regulatory demands, and desired long-term ROI.

| Criteria | Off-the-Shelf AI Agents | Custom AI Agents (Built for Insurers) |

|---|---|---|

| Setup Time | Rapid deployment; minimal configuration needed. | Moderate; requires discovery, design, and integration. |

| Flexibility | Fixed capabilities; limited workflow customization. | Fully adaptable to unique claims, underwriting, or compliance needs. |

| Integration | Connects with common tools but lacks deep data interoperability. | Designed for seamless integration with CRM, ERP, and policy-admin systems. |

| Compliance & Governance | Generic privacy and bias safeguards. | Built with industry-specific governance aligned with GDPR, HIPAA, SOC 2, and NAIC guidelines. |

| Scalability | Suitable for narrow, repeatable tasks. | Scales across multiple functions and data environments. |

| Maintenance & Evolution | Vendor-dependent; updates on fixed cycles. | Continuous optimization, retraining, and performance tuning based on insurer data. |

| Cost & ROI | Lower upfront cost but limited differentiation. | Higher initial investment with stronger, measurable ROI over time. |

Comparison of off-the-shelf vs custom AI agents for insurance, highlighting differences in setup time, flexibility, integration, compliance, scalability, and ROI

Off-the-shelf solutions can be valuable for quick wins, automating isolated tasks like document extraction or customer chat. However, they rarely capture the complexity of enterprise insurance workflows or meet evolving compliance standards.

Custom AI agents, by contrast, are engineered for precision, adaptability, and control. They leverage proprietary models, integrate with existing infrastructure, and evolve alongside business rules and regulations.

Leading Platforms and Frameworks for Building AI Agents in Insurance

Building effective AI agents requires a blend of language models, orchestration frameworks, and data platforms that work seamlessly across enterprise systems. Insurers adopting agentic AI should prioritize flexibility, interoperability, and governance-ready architectures.

1. LLM-Powered Frameworks

Frameworks such as LangChain, AutoGPT, and CrewAI enable multi-agent coordination and complex reasoning chains. These allow insurance-specific agents to process claims, validate risk, or draft policy documents by dynamically using multiple data and tool inputs.

2. Cloud AI Platforms

Leading providers like Azure Cognitive Services, AWS Bedrock, and Google Vertex AI offer enterprise-grade infrastructure, security, and scalability. These platforms are especially valuable for integrating NLP, image analysis, and predictive modeling into claims and underwriting processes.

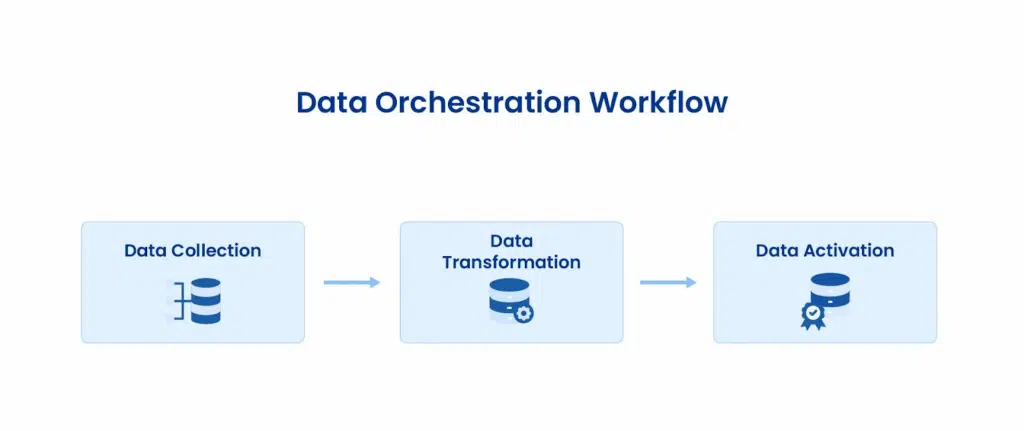

3. Data Orchestration & Storage Systems

Effective agents rely on unified, high-quality data. Platforms such as Databricks, Snowflake, and DataRobot streamline data ingestion, enrichment, and sharing across functions, making it easier for AI agents to learn, reason, and act reliably.

4. Enterprise Integration Ecosystems

Enterprise agents often operate alongside existing systems like Salesforce, Guidewire, or Duck Creek. Integration via APIs or middleware ensures that agentic automation complements, not disrupts, legacy infrastructure.

5. Multi-Agent Architectures

In advanced setups, insurers deploy multiple specialized agents, claims handlers, fraud monitors, compliance auditors that collaborate to complete end-to-end workflows. These multi-agent ecosystems enhance scalability, fault tolerance, and task specialization.

Future Trends: What’s Next for AI Agents in Insurance

The evolution of AI agents in insurance is only just beginning. As technology and data ecosystems mature, insurers will shift from task-based automation to intelligent, collaborative ecosystems where AI agents reason, negotiate, and improve autonomously. Several emerging trends are shaping that future.

1. Rise of Multi-Agent Collaboration

Future insurance operations will use multi-agent ecosystems, networks of specialized agents for claims, risk, compliance, and service that work together in real time. These agents will share data and insights across departments, improving consistency and operational speed.

2. Integration with IoT and Predictive Analytics

As connected devices and telematics proliferate, AI agents will interpret real-time data from vehicles, sensors, and wearables. This will enable predictive underwriting, proactive risk alerts, and dynamic pricing for usage-based insurance models.

3. Emergence of Agentic AI

Unlike rule-based automation, agentic AI systems can reason, plan, and act independently within set governance boundaries. They continuously optimize outcomes—adjusting claim routing, fraud thresholds, or underwriting parameters without manual triggers.

4. Hybrid AI Models Combining Generative and Agentic Intelligence

Next-generation insurers will combine generative AI (for content and interaction) with agentic intelligence (for reasoning and execution). For instance, a generative model might draft a claim explanation letter, while an agentic system verifies accuracy and files it automatically.

5. Human-AI Collaboration and Ethical Oversight

As autonomy increases, human oversight will remain essential. Future systems will balance speed and accountability, with humans guiding policy decisions and AI agents handling execution and optimization.

6. Regulatory and Ethical Standardization

Expect new regulatory frameworks defining how autonomous agents operate, make decisions, and record actions. Transparency, auditability, and explainability will become non-negotiable compliance factors.

Make AI Agents Work for Your Insurance Business with RTS Labs

AI agents are no longer a future concept—they’re a competitive advantage for insurers ready to modernize operations. From claims automation and underwriting to compliance and customer service, these intelligent systems are transforming how the industry operates: faster decisions, lower costs, and better customer experiences.

But realizing that potential requires more than technology. It takes a strategy-first approach that aligns automation with business goals, ensures ethical oversight, and integrates seamlessly with existing systems.

RTS Labs helps insurance leaders make AI adoption practical, safe, and scalable. Our teams:

- Architect custom AI agent ecosystems tailored to your workflows and compliance needs.

- Integrate seamlessly with legacy and modern data stacks, including Salesforce, Guidewire, Snowflake, Azure, and more.

- Embed governance and transparency to ensure every AI decision is explainable and auditable.

- Deliver measurable ROI through rapid prototyping, iterative scaling, and continuous optimization.

AI agents can reshape your business but only if implemented with precision, accountability, and strategy.

Partner with RTS Labs to build the next generation of intelligent insurance operations today.

FAQs

1. How long does it take to implement AI agents in an insurance workflow?

Most insurers begin seeing early results within 8–12 weeks. A phased rollout—starting with one workflow—helps teams validate accuracy, check system readiness, and tune performance before expanding across claims, underwriting, or compliance tasks.

2. Do AI agents replace existing insurance software platforms?

No. They work alongside current systems like Guidewire, Duck Creek, and Salesforce. Agents connect through APIs, use available data, and complete actions inside those platforms without forcing carriers to rework core infrastructure.

3. What skills do teams need to operate AI agents?

Teams don’t need deep technical backgrounds. They mainly need familiarity with workflows, ability to review outputs, and clarity on exception-handling steps. Most insurers train staff in basic oversight, QA checks, and data-handling practices.

4. Can small or midsize insurers use AI agents effectively?

Yes. Smaller carriers benefit because agents remove manual effort and help teams run lean operations. With the right use case—claims intake, policy updates, or simple underwriting checks—insurers can gain value without major transformation projects.

5. How do insurers measure success after deploying AI agents?

Most track cycle-time reduction, error rates, handoff accuracy, fraud detection uplift, and policyholder satisfaction. Dashboards give leaders visibility into actions, exceptions, and outcomes so they can confirm progress and fine-tune workflows.