Many finance leaders are moving toward systems that can handle forecasting, reconciliation, and compliance with minimal manual effort. Yet a clear gap remains: teams want more automation, but they often lack clarity into how these systems reach conclusions or flag risks.

Even with ongoing digital programs, finance departments still deal with slow forecasting cycles, limited risk visibility, and time-consuming month-end close processes. Traditional ERP extensions and basic automation tools reduce manual steps, but they don’t solve the deeper issue — the need for systems that can interpret data, apply judgment, and support decisions instead of only moving tasks from one stage to another.

AI agents for the finance market is a multi-billion-dollar industry projected to grow to $190.33 billion by 2030, at a CAGR of 30.6%, an AI in Finance report reveals.

Also Read: What is AI in Financial Planning?

In this article, we’ll break down what AI agents mean for finance, how they work, which platforms lead in 2026, and how RTS Labs helps organizations build audit-ready agentic ecosystems designed for accuracy, compliance, and long-term ROI.

What Exactly Are AI Agents for Finance, and Why Do They Matter?

AI agents for finance are autonomous, goal-driven systems that perceive financial data, reason through multiple variables like market volatility, compliance thresholds, and cash flow constraints, and then take context-aware actions such as reconciling accounts, generating forecasts, or flagging audit exceptions.

AI agents don’t stop at just executing rules. They learn, adapt, and justify their decisions, creating a fully audit-ready layer of intelligence across the finance function.

Modern finance teams sit at the intersection of complexity and velocity, and static reporting isn’t of much use today. Data streams from ERPs, payment platforms, market feeds, and compliance systems demand real-time interpretation.

AI agents, instead of relying on human-triggered workflows, autonomously interpret ledgers, detect anomalies, and even recommend or execute corrective actions.

Senior Vice President and CFO David Meyer from electrical supplies distributor Graybar, says, “We’ve already seen benefits to working capital and are expanding our use of data analytics, machine learning, and AI to enhance forecasting, optimize inventory, and increase cash flow,” he says. “On top of that, we will be applying scenario planning and predictive analytics capabilities to support analyzing acquisition and growth targets.”

Deloitte’s Finance Trends in Leadership findings reveal that AI is the second-best technology investment 49% of the CFOs are considering to improve cost savings across finance teams.

Top AI Agents for Finance in 2026

The financial services industry is entering an era where AI agents are moving from just being support tools to decision partners. From automating month-end close to detecting anomalies in real time, these systems blend reasoning, prediction, and execution to deliver measurable business impact.

While several platforms now embed AI capabilities into their financial workflows, RTS Labs stands apart for its custom, audit-ready, and explainable AI agents designed specifically for enterprise and mid-market finance functions.

Below is a comparative view of the top players shaping the AI-driven finance ecosystem in 2026.

| Company / Platform | Core Focus | Ideal Client Type | Key Strengths | Limitations |

|---|---|---|---|---|

| RTS Labs | Custom AI agents for forecasting, compliance, fraud detection, and finance automation | Mid-market to enterprise firms needing explainable, integrated AI | Tailored design; seamless integration across ERP, CRM, and BI tools; compliance-grade governance | Custom build time may exceed turnkey options |

| Workday Finance Agent | Embedded AI for expense management, planning, and reporting | Large enterprises using Workday ERP | Strong native automation and user experience | Limited outside Workday ecosystem |

| Oracle Cloud Financials AI | Predictive analytics, anomaly detection, and invoice automation | Large, data-heavy enterprises | Advanced analytics, robust integration with Oracle Cloud | High licensing cost, slower deployment |

| BlackLine Autonomous Close Agents | Month-end close, reconciliation, and journal entry automation | Mid-to-large finance teams | Streamlines close process, strong audit trail | Limited flexibility beyond close workflows |

| HighRadius Autonomous Finance Platform | Accounts receivable, treasury, and cash flow automation | Enterprise finance departments | End-to-end cash optimization and forecasting | Proprietary ecosystem limits cross-platform data flow |

| DataRobot Finance AI Suite | Predictive modeling for forecasting and credit risk | Financial institutions with strong data maturity | AI-powered risk and forecasting models | Requires significant model tuning and data ops maturity |

| UiPath Finance Automation Agents | Workflow automation and document intelligence | Mid-market and enterprise operations teams | Strong RPA + AI integration | Reactive automation; limited reasoning capabilities |

AI agents are leading that transformation of ‘how’ CFOs manage speed, accuracy, and compliance. Below are the top finance AI agents of 2026, starting with RTS Labs.

1. RTS Labs AI Agents: Custom, Audit-Ready Intelligence for Modern Finance

RTS Labs builds enterprise-grade, custom AI agents designed to automate, explain, and audit financial decisions in real time. RTS Labs’ systems integrate across your existing ecosystem, from ERP to CRM and compliance tools, to deliver traceable, intelligent decision-making.

These agents merge data engineering, machine learning, and governance by design, giving CFOs the confidence to automate without losing oversight.

RTS Labs Key Features

- Autonomous Reconciliation & Close Management: AI agents automatically match transactions, resolve discrepancies, and prepare audit logs, cutting close cycles considerably.

- Dynamic Forecasting & Liquidity Optimization: Continuously models cash flow and revenue forecasts using live ERP and market data, improving forecast accuracy by several notches.

- Continuous Compliance Monitoring: Built-in rule engines cross-verify every transaction for SOX, GDPR, and FINRA compliance for flagging anomalies in real time.

- Fraud Detection & Risk Scoring: Detects transaction anomalies through behavior-based modeling and network correlations, reducing false positives.

- Explainable AI Dashboards: Each decision is backed by transparent, human-readable reasoning, aligning perfectly with audit and regulatory standards.

RTS Labs Pros and Cons

RTS Labs Pros:

- Custom-built, domain-specific AI agents for end-to-end financial automation.

- Audit-ready architecture with explainable logic and bias monitoring.

- Deep integration with ERP, CRM, and compliance tools.

- Proven ROI and measurable impact within 3 to 6 months.

RTS Labs Cons:

- Longer setup time than plug-and-play tools.

- Requires initial data integration planning for optimal results.

RTS Labs Case Study

A mid-sized fintech firm partnered with RTS Labs to automate reconciliation and anomaly detection across multiple ERPs. The system identified mismatches, reconciled entries, and generated compliance-ready logs automatically.

Impact:

- 45% faster month-end close

- 60% reduction in manual errors

- 100% audit trail visibility

In another engagement with a national credit services provider, RTS Labs’ predictive risk agents improved delinquency monitoring accuracy by 38% and cut manual credit reviews by 50% — showcasing the platform’s blend of automation and intelligence.

RTS Labs Pricing

RTS Labs offers custom pricing based on the client’s data ecosystem and automation scope. Pricing is determined after a solution workshop, ensuring every deployment aligns with performance and ROI goals.

Client Testimonial

“RTS Labs made a huge difference for us. They didn’t just fix things; they completely changed how we help folks achieve their dream of owning a home. The AI system they brought in made the whole process quick and smooth. Our clients felt the difference, and the positive vibes we got from them spoke volumes.”

– Ms. Jessica Ramirez, CEO, DreamHome Mortgages

Another project involved a national credit services provider, where RTS Labs implemented predictive risk-scoring agents to identify delinquency trends. The system improved portfolio health monitoring accuracy by 38% and cut manual credit review times by over 50%.

Also Read: Decoding the finance revolution: RTS Labs’ Ai case studies unveiled

Why RTS Labs Stands Out?

RTS Labs doesn’t sell pre-packaged AI. It builds industry-grade intelligence systems that embed governance and adapt to evolving regulations, making them ideal for CFOs and finance transformation leaders who value transparency, agility, and measurable ROI.

2. Workday Finance Agent

Workday’s AI agent enhances its ERP ecosystem with automation for planning, reporting, and reconciliation. It is ideal for enterprises already using Workday for HR or finance.

Workday Key Features

- Real-time forecasting and variance analysis

- Automated journal entry validation

- Expense categorization and performance alerts

- Native integration across Workday suite

- Predictive insights for financial planning

Workday Pros and Cons

Pros: Seamless ERP integration, strong UX, predictive planning tools.

Cons: Closed ecosystem limits external integration; less flexible for hybrid setups.

Workday Pricing

Available as part of the Workday Financial Management suite; pricing is quote-based.

3. Oracle Cloud Financials AI

Oracle’s AI-driven finance layer supports predictive insights, anomaly detection, and smart invoice processing for large-scale enterprises.

Oracle Cloud Key Features

- Predictive analytics and trend modeling

- Intelligent invoice scanning

- Real-time anomaly detection

- Automated financial close tasks

- Native integration within Oracle Cloud

Oracle Cloud Pros and Cons

Pros: Strong analytics and compliance capabilities; ideal for data-heavy enterprises.

Cons: Complex setup, high licensing costs, limited customization.

Oracle Cloud Pricing

Subscription-based; varies by module and usage level.

4. BlackLine Autonomous Close Agents

BlackLine’s agents automate reconciliation, journal entry, and close cycle workflows for enterprise finance teams.

BlackLine Key Features

- Transaction matching and reconciliation

- Journal entry automation

- Risk flagging and exception handling

- Real-time audit trails

- Close cycle acceleration

BlackLine Pros and Cons

Pros: Reliable close automation; strong audit transparency.

Cons: Lacks forecasting and cross-functional intelligence.

5. HighRadius Autonomous Finance Platform

HighRadius delivers AI-powered AR, treasury, and cash optimization solutions using autonomous workflows.

HighRadius Key Features

- Cash forecasting and treasury visibility

- Credit scoring automation

- AR and AP optimization

- Real-time payment reconciliation

- AI-powered working capital management

HighRadius Pros and Cons

Pros: End-to-end cash visibility; excellent for treasury operations.

Cons: Limited flexibility outside native integrations; costly at scale.

6. SAP Joule AI Agents

SAP’s AI agent integrates across its finance suite, allowing users to query financial data, generate reports, and ensure compliance via natural language.

SAP Joule Key Features

- Natural-language financial queries

- Real-time compliance checks

- Forecasting support

- Embedded AI recommendations

- SAP-native data integration

SAP Joule Pros and Cons

Pros: Streamlines close and reporting; excellent for SAP environments.

Cons: Restricted to SAP ecosystem; limited customization for non-SAP users.

7. UiPath Finance Automation Agents

UiPath combines RPA and AI to automate repetitive back-office workflows for finance operations.

UiPath Key Features

- Invoice and document processing

- KYC verification

- Audit preparation

- Workflow orchestration

- Compliance flagging

UiPath Pros and Cons

Pros: Great for process automation; quick deployment.

Cons: Reactive, rule-based automation; limited reasoning and adaptability.

RTS Labs vs. Off-the-Shelf Finance Agents: At a Glance

Finance teams experimenting with AI-driven automation are weighing the trade-offs between custom-built solutions from partners like RTS Labs and generic, off-the-shelf finance agents.

Here’s a quick comparison of how these two approaches differ in flexibility, transparency, and long-term ROI.

| Criteria | RTS Labs (Custom Agentic AI) | Off-the-Shelf AI Tools (Workday, Oracle, etc.) |

|---|---|---|

| Integration | Cross-platform (ERP, CRM, compliance, BI) | Limited to native platforms |

| Compliance & Governance | Built-in auditability, explainability, rule-based oversight | Basic activity logs, no deep audit trails |

| Customization | Tailored to financial workflows, data models, and regulations | Predefined templates, limited flexibility |

| Scalability | Modular and expandable via APIs | Vendor-dependent scaling |

| Implementation Speed | Moderate (phased delivery) | Faster setup, limited adaptation |

| ROI Realization | Long-term, process-driven value | Short-term productivity boosts |

| Ideal Users | CFOs, Finance Ops, Risk & Compliance Teams | ERP-heavy finance departments |

When to Choose RTS Labs

You must choose RTS Labs for building custom AI solutions for your organization, if:

- Your organization manages multi-source financial data across ERPs, CRMs, and reporting tools.

- You require audit-ready AI systems that meet governance and compliance standards.

- You want autonomous agents that do more than automate, i.e., they reason, forecast, and explain their decisions.

- You value a hands-on partner that builds, integrates, and continuously monitors AI for long-term results.

What Are the Benefits and Use Cases of AI Agents in Finance?

For small and mid-sized enterprises (SMEs) especially, AI agents help in moving from reactive reporting to proactive financial intelligence that drives measurable efficiency, accuracy, and compliance.

Deloitte’s latest survey finds that 63% of the finance leaders have fully deployed and are actively using AI solutions in the finance function. However, many are yet to reach the scale and amplitude needed to reach measurable impact.

The Business Value of AI Agents in Finance

AI agents enhance both operational efficiency and decision quality by working continuously across systems like ERP, CRM, and financial planning software. Their benefits can be grouped under three major impact areas:

1. Efficiency and Cost Reduction

- These agents automate manual close, reconciliation, and reporting steps, freeing finance teams from hours of data wrangling.

- Financial AI agents reduce month-end cycle times by up to 40%, and improve operational efficiency and accuracy by 30%.

- They streamline accounts payable and receivable with adaptive learning agents that flag anomalies instantly.

2. Forecasting Accuracy and Decision Agility

- These process live feeds from market, transaction, and ledger data to project liquidity, revenue, and working capital positions.

- Predictive finance agents use multi-source data modeling to help firms anticipate budget variances before they occur, improving forecast accuracy.

3. Governance, Compliance, and Trust

- Every decision made by an AI agent is audit-ready, logged, traceable, and explainable.

- These agents automatically detect compliance breaches or suspicious transactions in real time, ensuring readiness for SEC, FINRA, or SOX audits.

7 Real-World Use Cases of AI Agents in Finance

Finance teams are achieving efficiency, accuracy, and cost-effectiveness by using these intelligent systems that handle routine, data-heavy tasks with precision.

Here are seven practical examples of how AI agents are already making finance faster, sharper, and more efficient.

1. Autonomous Financial Close and Reporting

Agents orchestrate month-end workflows by reconciling accounts, validating entries, and preparing reports automatically. The agent connects QuickBooks and NetSuite with audit-ready logs to reduce manual reconciliation hours, which results in faster close cycles, fewer errors, and real-time variance visibility.

2. Credit Risk Scoring and Underwriting

AI agents evaluate creditworthiness using structured data, like credit history, balance sheets, etc., and unstructured data like transaction behavior, communication, etc. Custom risk agents combine predictive analytics and explainable AI to meet evolving regulatory transparency standards.

One of our clients experienced 50% faster loan approvals and consistent risk assessment accuracy across portfolios after RTS Labs’ agents were integrated into their systems.

3. Real-Time Fraud Detection and Resolution

AI agents scan transactions, flag anomalies, and trigger escalation workflows autonomously. This results in lower fraud losses, instant alerts, and automatic case logging for compliance teams.

We deployed an anomaly detection framework that helped a credit service provider identify suspicious activity and reduced fraud-related financial losses

4. Treasury and Liquidity Optimization

Agents continuously model cash flow scenarios, project liquidity needs, and suggest fund reallocations based on market or rate movements. These agents integrate these agents with ERP and market data sources to ensure CFOs have real-time visibility and auto-generated recommendations.

5. Compliance Monitoring and Audit Trail Generation

Agents cross-check every transaction against internal controls and external regulations. They flag inconsistencies and generate human-readable audit logs. We build agents that explain their decision logic for ensuring accountability and regulatory confidence. We helped a client cut their audit preparation time by half and achieve higher compliance scores in internal audits.

6. Predictive Forecasting and Budget Control

AI agents continuously analyze revenue, expense, and market data to refine forecasts and alert decision-makers to variance risks. We built a forecasting agent for a manufacturing finance team that merged production and sales data streams and achieved better forecast accuracy and faster variance analysis.

7. Customer Finance Engagement

Agents analyze client portfolios, spending patterns, and risk tolerance to generate personalized recommendations or upsell opportunities. These agents integrate conversational AI with agentic backends to provide personalized, compliant financial advice across channels.

We helped WealthPlus Advisors experience improved customer satisfaction scores by 35%, 20% increase in client retention rates, and 25% in new client acquisitions.

Why Audit-Ready Agentic Workflows Are the Future of Financial AI

In finance, automation without accountability is a risk multiplier. The next generation of financial AI agents isn’t just intelligent. It’s audit-ready. Regulators, auditors, and boards all want the same thing, i.e., trustworthy AI systems that can justify every action and decision.

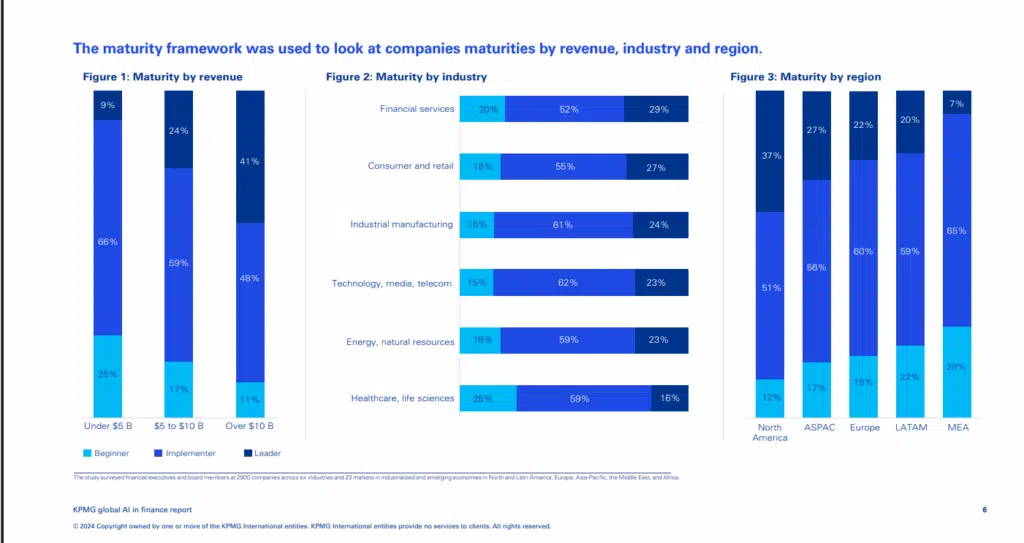

A KPMG survey ranked AI implementations across industries as 18% beginners in AI usage, 58% as implementers, and 24% as leaders.

As finance teams rely on vast data flows across forecasting, compliance, and reconciliation, data lineage, bias, and model drift introduce real operational and reputational risks. That’s why audit-ready AI solutions having transparent logic, traceable decisions, and verifiable outputs are becoming essential for financial integrity and regulatory confidence.

What Does Audit-Ready Mean in the Context of AI Agents?

In an enterprise finance environment, every autonomous decision must be:

- Traceable: Each transaction, forecast, or flag must carry a clear decision lineage, i.e., who/what made it, why, and under what conditions.

- Explainable: The reasoning behind predictions, e.g., credit risk scoring or anomaly detection, must be transparent to auditors and compliance teams.

- Governed: All data usage, model updates, and actions must comply with internal controls, SOX requirements, and emerging AI governance standards, such as the EU AI Act.

RTS Labs’ Approach: Built-In Governance by Design

RTS Labs builds agentic AI systems that think and act transparently. Each financial agent comes embedded with governance controls that align with enterprise audit, compliance, and IT policies.

Core Elements of RTS Labs’ Audit-Ready Architecture:

- Decision Logging: Every decision the agent makes, from a forecast adjustment to a fraud alert, is timestamped and documented in a human-readable audit trail.

- Explainable AI Models: RTS Labs incorporates SHAP (SHapley Additive exPlanations) and counterfactual reasoning frameworks that let compliance teams see why the model reached a specific decision.

- Role-Based Access Controls (RBAC): Ensures sensitive data is only accessible to authorized roles and aligns with ISO 27001 and SOC 2 frameworks.

- Bias and Fairness Monitoring: Periodic audits detect and correct skewed outcomes, e.g., risk scoring bias by region or demographic.

- Human-in-the-Loop (HITL): Critical financial decisions, such as credit approvals, regulatory reports, require human validation, ensuring AI augments, not replaces, expert oversight.

What’s Next for AI Agents in Finance?

The next wave of AI in finance won’t just automate workflows. Rather, it will reshape decision-making itself. According to Gartner’s 2026 Finance AI Outlook, by 2027, 40% of finance departments will deploy autonomous agents that execute judgment-based decisions under human oversight. The evolution signals the shift from rule-based automation to reason-based orchestration.

Some emerging trends shaping finance AI include:

-

Multi-Agent Financial Ecosystems

Finance teams will deploy multiple specialized agents for forecasting, liquidity, and compliance, working in concert to manage the full financial lifecycle.

-

Generative + Agentic Convergence:

Generative models will analyze financial text, such as contracts, filings, and notes, while agentic systems execute based on those insights to close the loop between insight and action.

-

Continuous Compliance & Audit Automation

Audit-ready, self-explaining agents will maintain 24/7 transparency to reduce audit prep time by over 50%, per EY’s 2024 Finance AI Audit Study.

-

Human-AI Collaboration

AI won’t replace financial analysts or controllers but will augment them.Our hybrid systems ensure human review for all material decisions, creating a balance between speed and governance.

How Can You Make AI Agents Work for Your Finance Business with RTS Labs?

AI agents are fast becoming the strategic backbone of modern finance operations.

But success doesn’t come from deploying more tools. It comes from building the right agentic ecosystem aligned with your data, your compliance mandates, and your KPIs.

Whether you’re a growing SME or an enterprise finance leader, RTS Labs helps you turn automation into intelligence, and intelligence into accountability.

Ready to future-proof your finance operations?

Partner with RTS Labs to design audit-ready AI agents that deliver clarity, compliance, and competitive edge.

FAQs

1. What makes an AI agent different from traditional RPA or finance bots?

AI agents can reason, plan, and adapt rather than just follow pre-coded rules like RPA bots. They learn from feedback and collaborate across multiple systems to achieve financial goals.

2. How do AI agents improve financial forecasting accuracy?

They continuously analyze multi-source data, such as ERP, market, and CRM, to update forecasts in real time, reducing variance errors.

3. Are AI agents safe to deploy in regulated finance environments?

Yes, RTS Labs builds audit-ready agents with explainable decisions, bias monitoring, and role-based access controls that comply with SOX, GDPR, and FINRA standards.

4. What’s the ROI timeline for AI agent adoption in finance?

Most RTS Labs clients begin seeing measurable impact, such as shorter close cycles and lower audit prep time, within 3–6 months of deployment.

5. Can RTS Labs build AI agents tailored to my finance function?

RTS Labs develops custom agentic systems that integrate with your ERP, treasury, or compliance stack to ensure scalability, transparency, and sustainable ROI.